Raymond James Financial, Inc., a financial holding company, through its subsidiaries, engages in the underwriting, distribution, trading, and brokerage of equity and debt securities, and the sale of mutual funds and other investment products in the United States, Canada, Europe, and internationally. The company operates through Private Client Group, Capital Markets, Asset Management, RJ Bank, and Other segments. The Private Client Group segment provides securities brokerage services, including the sale of equities, mutual funds, fixed income products, and insurance products to their individual clients; and borrowing and lending of securities to and from other broker-dealers, financial institutions, and other counterparties. The Capital Markets segment offers securities brokerage, trading, and research services to institutions with a focus on sale of the United States and Canadian equities and fixed income products; and manages and participates in underwritings, merger and acquisition services, and public finance activities. The Asset Management segment engages in the operations of Eagle, the Eagle Family of Funds, Cougar, the asset management operations of Raymond James & Associates, trust services of Raymond James Trust, and other fee-based asset management programs. The RJ Bank segment originates and purchases commercial and industrial loans, tax-exempt loans, securities based loans, and commercial and residential real estate loans. The Other segment engages in principal capital and private equity activities, including various direct and third party private equity investments; employee investment funds; and private equity funds. Raymond James Financial, Inc. was founded in 1962 and is headquartered in St. Petersburg, Florida.

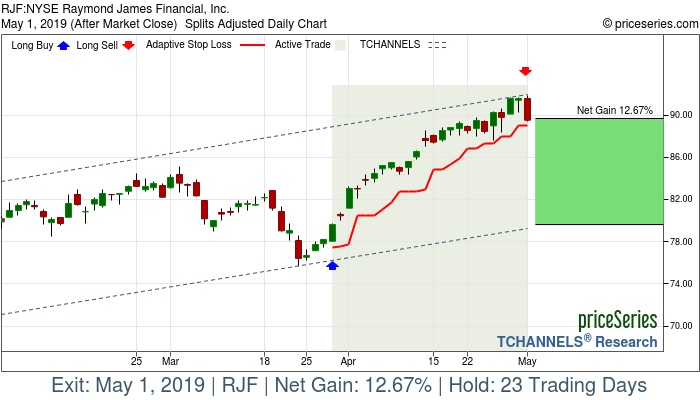

Trade Type

| ReliabilityScore™

| Entry Date

| Entry Price

| Sell Date

| Sell Price

| Net Gain

| Hold Time

|