Republic Bancorp, Inc., a financial holding company, provides banking products and services in the United States. It operates in four segments: Traditional Banking, Warehouse Lending, Mortgage Banking, and Republic Processing Group. The company accepts demand, savings, time, and brokered and other certificates of deposits; and money market and individual retirement accounts. Its loan products include single family, first lien residential real estate, and adjustable rate mortgage loans; commercial and industrial, commercial real estate, municipal, and multi-family loans, as well as equipment financing; construction and land development loans; Internet and correspondent lending; home improvement and home equity, and secured and unsecured personal loans; and automobile loans. The company also offers credit cards; title insurance and other financial products and services; and private banking, lockbox processing, remote deposit capture, business on-line banking, account reconciliation, automated clearing house processing, and Internet and mobile banking services. In addition, it provides short-term and revolving credit facilities to mortgage bankers; tax refund solutions, which facilitates the receipt and payment of federal and state tax refund products through third-party tax preparers and tax-preparation software providers; short-term consumer credit products; and general purpose reloadable prepaid cards through third party program managers. Further, the company offers property and casualty insurance services. As of February 6, 2017, it operated 45 banking centers, including 33 banking centers in 12 Kentucky communities; 3 in southern Indiana; 6 in Florida; 2 in Tennessee; and 1 in Ohio. Republic Bancorp, Inc. was founded in 1974 and is headquartered in Louisville, Kentucky.

Trade Type

| ReliabilityScore™

| Entry Date

| Entry Price

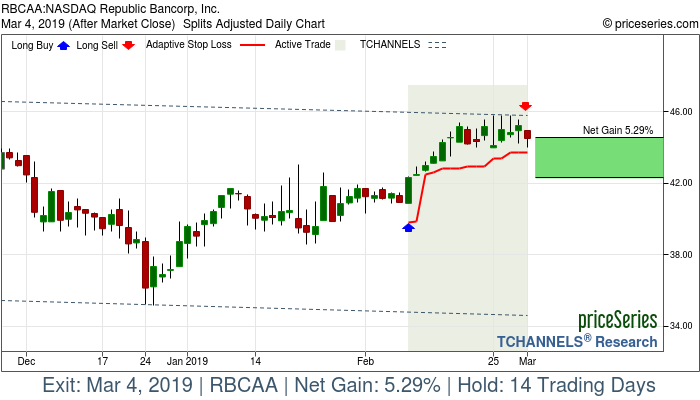

| Sell Date

| Sell Price

| Net Gain

| Hold Time

|