The PNC Financial Services Group, Inc. operates as a diversified financial services company in the United States and internationally. The company's Retail Banking segment offers deposit, lending, brokerage, investment management, and cash management services to consumer and small business customers through branch network, ATMs, call centers, online banking, and mobile channels. As of December 31, 2016, this segment operated a network of 2,520 branches and 9,024 ATMs. Its Corporate & Institutional Banking segment provides secured and unsecured loans, letters of credit, equipment leases; and cash and investment management, receivables management, disbursement and funds transfer, information reporting, trade, foreign exchange, derivatives, securities, loan syndications, mergers and acquisitions advisory, and equity capital markets advisory related services for corporations, government, and not-for-profit entities. This segment also offers commercial loan servicing and technology solutions for the commercial real estate finance industry. The company's Asset Management Group segment provides investment and retirement planning, customized investment management, private banking, tailored credit, and trust management and administration solutions; multi-generational family planning products; and mutual funds and institutional asset management services to individuals and their families. Its Residential Mortgage Banking segment offers first lien residential mortgage loans. The company's BlackRock segment provides investment and risk management services to institutional and retail clients. Its Non-Strategic Assets Portfolio segment offers residential mortgage and brokered home equity loans and lines of credit, as well as commercial real estate loans and leases. The company was founded in 1922 and is headquartered in Pittsburgh, Pennsylvania.

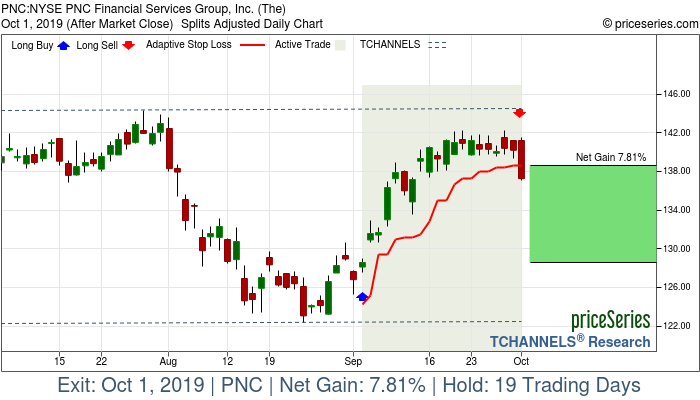

Trade Type

| ReliabilityScore™

| Entry Date

| Entry Price

| Sell Date

| Sell Price

| Net Gain

| Hold Time

|