Preferred Bank provides various commercial banking products and services to small and mid-sized businesses and their owners, entrepreneurs, real estate developers and investors, professionals, and high net worth individuals in the United States. The company's deposit products include checking, savings, negotiable order of withdrawal, and money market deposit accounts; fixed-rate and fixed maturity retail certificates of deposit; and individual retirement accounts and non-retail certificates of deposit. It also provides real estate mini-perm loans that are secured by retail, industrial, office, special purpose, residential, and residential multi-family properties; real estate construction loans; commercial loan products comprising lines of credit for working capital and term loans for capital expenditures; and trade finance products, such as commercial and standby letters of credit, acceptance financing, documentary collections, foreign draft collections, international wires, and foreign exchange for importers and exporters. In addition, the company offers various high-wealth banking services to wealthy individuals residing in the Pacific Rim area with residences, real estate investments, or businesses in Southern California. Further, it provides various banking services to physicians, accountants, attorneys, business managers, and other professionals; and a range of deposit products and related services, such as safe deposit boxes, account reconciliation, courier service, and cash management services to the manufacturing, service, and distribution companies. As of December 31, 2016, the company had 12 full-service branch offices in Alhambra, Arcadia, Century City, City of Industry, Diamond Bar, Los Angeles, Pico Rivera, San Francisco, Tarzana, Torrance, Anaheim, and Irvine, California, as well as Flushing, New York. Preferred Bank was founded in 1991 and is headquartered in Los Angeles, California.

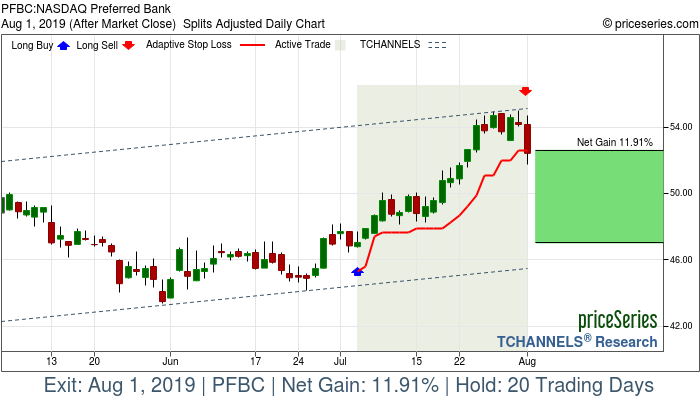

Trade Type

| ReliabilityScore™

| Entry Date

| Entry Price

| Sell Date

| Sell Price

| Net Gain

| Hold Time

|